- Basic approach to Corporate Governance

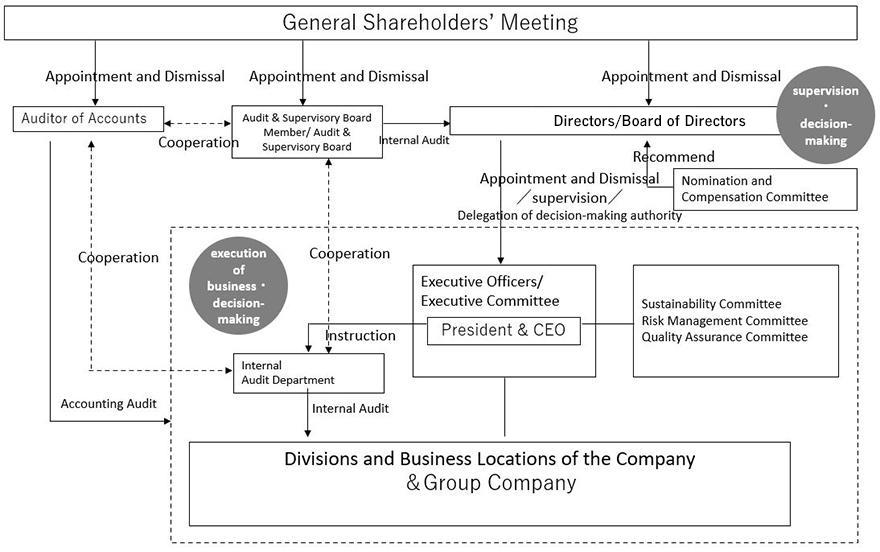

- Diagram: System of Corporate Governance

- Effectiveness of the Board of Directors

- Status of Outside Officers

- Internal Control System

- Executive Compensation

Basic approach to Corporate Governance

With a view to improving the profitability and the capital efficiency of Nissui and its Group companies, as well as to promoting initiatives toward corporate social responsibility to encourage sustainable growth and the medium- to long-term enhancement of corporate value, the Board of Directors will demonstrate the major direction in corporate strategies and other matters and will place greater emphasis on supervising functions while retaining important decision-making functions.

The decision-making functions have been empowered to the Executive Officers (and Executive Committee) headed by the President & CEO, to speed up the decision-making process and to further separate supervising and execution.

Furthermore, in addition to the above management supervising by the Board of Directors, Nissui has adopted the governance structure of a company with an audit & supervisory board, based on its belief in the effectiveness of an audit system over management comprising four Audit & Supervisory Board Members including Outside Audit & Supervisory Board Members who are independent of management.

Diagram: System of Corporate Governance

<Board of Directors>

The Board of Directors Meeting is held at least once a month in principle to determine material matters and supervise management. In order to enhance the transparency of management and strengthen the function of management supervision, Directors act with a term of office of one year. Currently, the Board of Directors consists of ten Directors and includes four Outside Directors (of which two members are women), who are independent of the management team.

<Nomination and Compensation Committees>

As an advisory body to the Board of Directors, the Company has established the voluntary Nomination and Compensation Committees (established on June 27, 2018), consisting of four Outside Directors and two Representative Director and chaired by an Outside Director. The Nomination Committee deliberates on the selection and dismissal of candidates for Officers including President and succession planning, and the Compensation Committee deliberates on the determination policy of compensation, details of the compensation system, and compensation standard, among other matters, in order to recommend to the Board of Directors. The Board of Directors determines officer appointments and compensation based on the recommendation.

Management Structure and Expected Areas of Expertise of Directors and Audit & Supervisory Board Members

| Name | Positions and responsibilities | Corporate management |

Finance and accounting |

Marketing and sales |

Production and technology |

R&D | International perspective |

Corporate governance |

Risk management |

Legal affairs and compliance |

Sustainability |

|---|---|---|---|---|---|---|---|---|---|---|---|

Hamada |

Chairman of the Board of Directors and Representative Director, Member of Nomination and Compensation Committees |

○ | ○ | ○ | ○ | ○ | ○ | ○ | ○ | ||

Tanaka |

Representative Director, President, Chief Executive Officer (CEO), Member of Nomination and Compensation Committees |

○ | ○ | ○ | ○ | ○ | ○ | ○ | ○ | ||

Yamamoto |

Director, Senior Managing Executive Officer, Chief Financial Officer (CFO) |

○ | ○ | ○ | ○ | ○ | |||||

Umeda |

Director, Senior Managing Executive Officer, Chief Operating Officer (COO) |

○ | ○ | ○ | ○ | ○ | |||||

Asai |

Director, Managing Executive Officer | ○ | ○ | ○ | ○ | ○ | |||||

Kuraishi |

Director, Executive Officer | ○ | ○ | ○ | |||||||

Matsuo |

Outside Director, Chairperson of Nomination and Compensation Committees |

○ | ○ | ○ | ○ | ○ | ○ | ||||

Eguchi |

Outside Director, Member of Nomination and Compensation Committees |

○ | ○ | ○ | ○ | ||||||

Abe |

Outside Director, Member of Nomination and Compensation Committees |

○ | ○ | ○ | ○ | ○ | ○ | ||||

Tanaka |

Outside Director, Member of Nomination and Compensation Committees |

○ | ○ | ○ | ○ | ○ | |||||

Hamano |

Standing Audit & Supervisory Board Member | ○ | ○ | ○ | ○ | ○ | |||||

Terahara |

Outside Audit & Supervisory Board Member | ○ | ○ | ○ | ○ | ○ | |||||

Jingu |

Outside Audit & Supervisory Board Member | ○ | ○ | ○ | ○ | ○ | |||||

Tadokoro |

Outside Audit & Supervisory Board Member | ○ | ○ | ○ | ○ |

<Audit & Supervisory Board>

Regarding the audit system, the Company has appointed persons with the expertise necessary for audit including insight into finance and accounting as well as a wealth of knowledge in a wide range of fields. The Audit & Supervisory Board consists of four Audit & Supervisory Board Members including three Outside Audit & Supervisory Board Members (of which one member is a woman) independent of the management team. Each Audit & Supervisory Board Member attends the Board of Directors meetings to audit execution of duties of Directors, and also attends other important meetings including the Executive Committees as necessary.

<Executive Committee>

Regarding business execution, the Company has adopted the executive officer system (introduced on June 25, 2009) for flexible and efficient business management. The Executive Committee consisting of Executive Officers appointed by the Board of Directors is held at least once a month in principle, and makes quick and appropriate decisions and information sharing on major business execution matters, based on sufficient deliberation from a multifaceted perspective, in order to promote the sustainable growth and the enhancement of the corporate value of the Company and the Group.

<Internal Audit(Internal Audit Department)>

Based on annual planning, the internal auditing division under the direct control of President implements evaluation on internal control in order to ensure the reliability of internal audit and financial reporting of the Group, and reports results to Directors, Audit & Supervisory Board Members, and the managers of organizations under audit.

The internal auditing division reports the business audit results of Nissui and all its Group companies to the Audit & Supervisory Board Members, and in terms of internal control, discusses the evaluation procedure, scope, schedule, etc. with the external auditor of accounts when formulating the evaluation plan for the fiscal year and finalizes the evaluation policy. Furthermore, we ensure cooperation between the external auditor of accounts and the internal auditing division by closely exchanging information with the external auditor of accounts and taking appropriate corrections when any deficiencies or problems in control are found.

<Auditor of Accounts>

Regarding accounting audits, the Company has concluded an agreement with Ernst & Young ShinNihon LLC to conduct accounting audits based on the Companies Act and the Financial Instruments and Exchange Act.

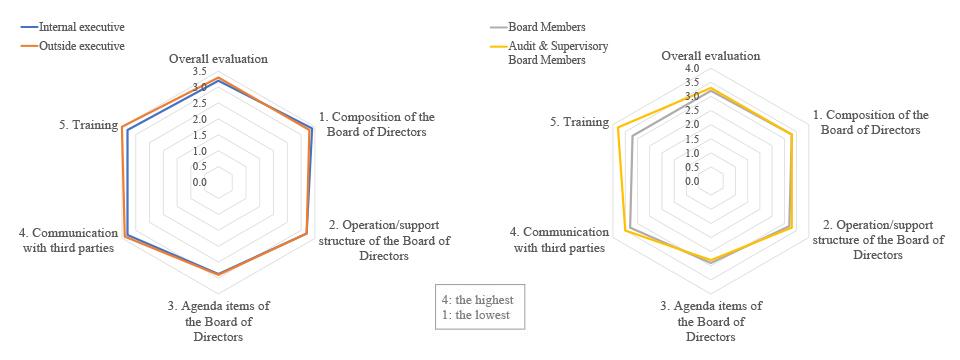

Effectiveness Evaluation of the Board of Directors

The Company has evaluated the effectiveness of the Board of Directors through questionnaires and discussions each year since FY2016. From FY2022, to grasp the issues and how they are being overcome through fixed-point surveys, it has conducted point-system questionnaires containing the same questions each year (with optional description fields) for all officers, while new officers are also subject to supplementary interviews to explain their answers to the description fields in the questionnaires. Issues that have come to light through the questionnaires and interviews are identified, and discussions, separate from the framework of the Board of Directors and facilitated by an Outside Director, are held with all executives to deliberate ways of overcoming the issues.

<Timeline>

The Company evaluated the effectiveness of the Board of Directors ("effectiveness evaluation") for FY2024 on all executives (ten Directors and four Audit & Supervisory Board Members) in accordance with the following timeline.

- January 2025

- Conducted a point-system (4 levels) questionnaire survey

- February to March 2025

- Upon summarizing the questionnaire results, the secretariat conducted interviews with newly appointed Directors and identified issues

- April 2025

- Discussions separate from the Board of Directors were facilitated by an Outside Director

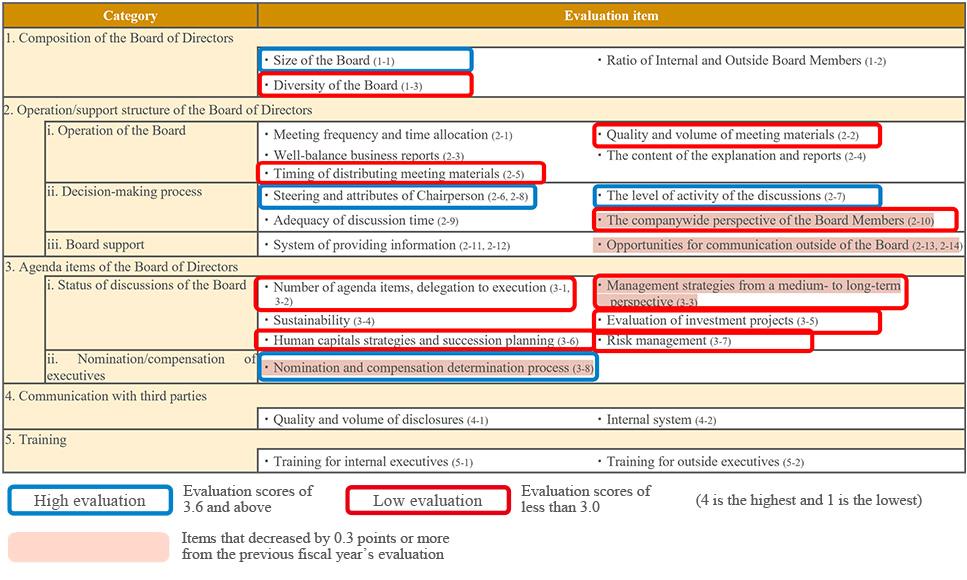

<The content of the questionnaire and a summary of the results>

(1) The content of the questionnaire

To understand the whole situation of the Board of Directors, the questionnaire comprised a total of 29 questions in the following five major categories. Each major category also had a free-description field where the respondent could write down comments and observations.

- i.Composition of the Board of Directors (size, number of members, diversity, the ratio of Internal and Outside Directors, etc.)

- ii.Operation of the Board of Directors and the support structure (annual schedule, the content and volume of meeting materials, the leadership of the Chairperson, etc.)

- iii.Agenda of the Board of Directors (number of agenda items and the content of the agenda items, the relevance of the criteria for submitting proposals to the Board of Directors, etc.)

- iv.Communication with third parties (the quality and the appropriateness of the content of disclosures to stakeholders, etc.)

- v.Training of Internal and Outside Directors

(2) Summary of the results

[Overview]

A comparison of the major categories indicated that while there were no significant differences in the evaluations between the internal officers and outside officers, in recent years, internal officers tended to be more aware of their roles and scored themselves more strictly in their self-assessments, resulting in lower scores for the internal officers than for the outside officers.

As a result of improving IR activities, "iv. Communication with third parties" continued to score high, and likewise, "v. Training" also scored high due to providing outside officers with opportunities to deepen their understanding of the Company's businesses, through visits to the Company's plants and subsidiaries. Meanwhile, "iii. Agenda items of the Board of Directors" scored lower than the other evaluation items.

[Summary]

Although the high-scoring and low-scoring items were mostly as per previous years, due to stricter self-assessments by the internal officers and also as changes were made to nearly half of the outside officers this year, there was a slight increase in the number of items that scored lower than last year. While the various improvement measures taken by the secretariat, such as holding preliminary explanation briefings in response to requests for the effectiveness evaluation last year, gained a certain level of recognition, "iii. Agenda items of the Board of Directors" scored low for many items.

<Issues identified through the questionnaire and interviews>

Upon summarizing the results of questionnaire and individual interviews, the following issues were identified.

- 1)Clarification of the positioning of the Board of Directors

Balance between the roles of "oversight" and "the highest level of decision-making of management" - 2)Improvement of the diversity of the Board of Directors

- 3)Arrangement of management themes lacking in medium- to long-term discussion

- 4)Improvement of the quantity, quality, and timing of materials provided for the Board of Directors meetings

<Summary of the discussion and next actions>

"Issues identified through the questionnaire and interviews," indicated above, have all been pointed out from the beginning as issues of the Company. Consequently, this year's discussion focused on reaching a consensus on measures and the timeline for solving the above issues.

- i.Clarification of the position of the Board of Directors: Striking a balance between the roles of "supervision" and "the highest level management decision making"

Given that the majority of the Internal Directors hail from the business divisions, the Company's Board of Directors has often been described in the past as having salient qualities of being "the highest level management decision-making" body. Some Internal Directors from the business divisions reflected that although they understood the supervisory functions of the Board of Directors, they found it difficult to distinguish between their managerial and supervisory roles, and as a result, the Board of Directors tended to become a venue for asking the Outside Directors for their approval. However, discussions by the Board of Directors on the judgment of Internal Directors and the assessments by Outside Directors can be meaningful from the standpoint of strategic intentions and risk-taking. Therefore, putting excessive weight on the supervisory functions without a sufficient understanding of the business is not necessarily appropriate for the Company, and, on the contrary, the Board of Directors, as the highest level management decision-making body, maintaining functions to determine the direction of the Company, including its businesses, is thought to be crucial, considering the current business scale of the Company. Furthermore, considering that a change in the mindset of the Internal Directors as "Directors" is taking place, the Company confirmed that there was no need to change the current Board of Directors through changes in the governance structure or other means. - ii.Improvement of the Board of Directors' diversity

Although there are two female Outside Directors on the Board of Directors, the Internal Directors are all male and Japanese. The Executive Committee is also all male and Japanese. We have always shared an awareness that something needs to be done to change this in the near future. Considering the Company's current situation, it would be difficult to immediately appoint any female Internal Directors. However, as a result of steady human capital development, we have recently appointed one female Executive Officer from within the Company. Although she is the only one, we have high hopes for her becoming a familiar home-grown role model for our female employees. On the other hand, while the Company is aiming to raise the ratio of sales in overseas locations to 50% by 2030, having prioritized the empowerment of women, we have no foreign nationals in our Board of Directors or the Executive Committee. Nevertheless, we decided to leave it to the Nomination Committee to continue concrete discussions on diversity, and we shared the understanding that there will be more diversity in the future. - iii.Sorting management themes for which medium- to long-term discussions have been insufficient

Although the Directors all shared awareness of the need to enhance the quality of medium- to long-term discussions, the perceptions of the individual Directors differed significantly, which has led to insufficient discussions at the meetings of the Board of Directors. To break through this deadlock, the Directors once again confirmed the need to form a common understanding among the Directors through informal discussions that will enable the candid exchange of opinions. In specific terms, to bridge the gap between our current business portfolio and our future ideal business portfolio, opportunities for discussions of basic matters should be provided, for example, on what and how should be done, and by when to do it, considering its impact on the Group 10 years from now and 20 years from now. In FY 2025, the Company plans to hire outside consultants and hold several workshops that also include Executive Officers to improve the discussions on management strategies through informal discussions. - iv.Improvement of the quantity, quality, and timing of distribution of materials for the Board of Directors meetings

The Directors have always voiced the view that the key points of the materials were not narrowed down, there was too much information, and that they were distributed too late. In response to these opinions, this year, preliminary explanations were given to outside officers on certain agenda items, which was recognized to a certain extent. However, as the volume of materials was excessive, requests were made to consider measures such as attaching summaries of the key points of agenda items for which preliminary explanations were not given. In FY2025, the Company decided to also adopt a format similar to that of business reports for agenda items to be deliberated.

Through these discussions, a consensus was reached on specific measures and the timeline. Going forward, we will work to continuously enhance the effectiveness of the Board of Directors of the Company through steady execution and regular reviews.

Status of Outside Officers

Outside Directors

| Name | Reason for Appointment |

|---|---|

| Tokio Matsuo | In addition to many years of experience at a glass manufacturer, Mr. Tokio Matsuo has broad expertise accumulated as a Representative Director of a listed chemical manufacturer. He has appropriately supervised overall management by expressing his frank opinions on sustainability initiatives from medium- and long-term perspectives. The Company has reappointed him as an Outside Director in anticipation that he will provide advice to further enhance corporate value. In addition, he is expected to demonstrate leadership as the Chairperson of the Nomination and Compensation Committees. |

| Atsumi Eguchi | Ms. Atsumi Eguchi has engaged in research & development and public relations/communications divisions at major beverage and food manufacturing companies and has broad knowledge and abundant experience. The Company reappointed her as an Outside Director in the expectation that she will appropriately supervise overall management from a perspective of corporate communication and diversity at the Board of Directors meetings, etc. of the Company. |

| Daisaku Abe | Mr. Daisaku Abe has engaged in a wide range of operations such as IT, systems, and corporate planning at financial institutions over a long period of time and has broad expertise in sustainability, including having served as chairman of the Human Rights Enlightenment Promotion Committee. In addition to his experience supervising overall corporate management as a corporate manager of a financial institution, he has also served as an outside director of a listed company. The Company reappointed him as an Outside Director with the expectation that he would supervise the management of the Company from medium- to long-term, and comprehensive perspectives by leveraging his various experiences. |

| Keiko Tanaka | Ms. Keiko Tanaka has engaged in public relations and marketing departments at automotive manufacturing companies, and as a result gaining broad knowledge. In addition, she has global experiences such as having served as the Ambassador Extraordinary and Plenipotentiary of Japan to Uruguay. Since she also has experience as an Outside Director at a listed company and as an Outside Expert of the Sustainability Committee, the Company reappointed her as an Outside Director in the expectation that she would provide advice from a global perspective on sustainability and diversity, which are current challenges that the Company needs to address, and supervise overall management based on various experience. |

The four Outside Directors all meet the independence requirements set by the Tokyo Stock Exchange and the "Independence Criteria of Outside Executives" set by the Company. There is no risk of conflicts of interest with general shareholders. The Company has determined that they are independent, designated them as independent directors according to the provisions of the Tokyo Stock Exchange, and notified the Exchange.

Outside Directors exchange information and opinions as necessary in response to reports from the Internal Audit Department.

Outside Audit & Supervisory Board Members

| Name | Reason for Appointment |

|---|---|

| Makiko Terahara | Ms. Makiko Terahara is well versed in corporate legal affairs as an attorney at law and serves as an Outside Director of other listed companies. She has professional expertise in determining the appropriateness of overall corporate activities. In addition, she serves as an Outside Audit & Supervisory Board Member of a listed company engaged in the department store business and possesses insights into the retailing business. The Company reappointed her as an Outside Audit & Supervisory Board Member in the anticipation that her advice based on her experience and insights would be effective for the Company to promote sustainability and attain diversity. |

| Tomoshige Jingu | Mr. Tomoshige Jingu has experience as a corporate manager and a full-time Audit & Supervisory Board Member of companies listed on the Prime Market of the Tokyo Stock Exchange, and as President and Representative Director of subsidiaries of a listed company. The Company newly appointed him as an Outside Audit & Supervisory Board Member in the anticipation that his advice based on his broad experience in sales, human resources, and other areas at financial institutions will be effective. |

| Takeshi Tadokoro | Mr. Takeshi Tadokoro has abundant experience as an accounting expert, including serving as a Representative Partner of a major audit firm as a certified public accountant. In addition, he has experience in advisory and human resources planning for financial reporting in the manufacturing, distribution, and service sectors at a major audit firm, and he has a wide range of personal connections and insight. The Company newly appointed him as an Outside Audit & Supervisory Board Member in the anticipation that he will provide advice and recommendations based on his experience and insight. |

Since all three Outside Audit & Supervisory Board Members meet the requirements for Independent Directors stipulated by the Tokyo Stock Exchange and the "Independence Criteria of Outside Executives" set by the Company, the Company has determined they are independent and there is no risk of conflicts of interest with general shareholders. So, the Company designated them independent directors according to the Tokyo Stock Exchange provisions and notified the Exchange.

Outside Audit & Supervisory Board Members receive regular reports from the Accounting Auditor on audit plans and results, witness some of the auditor's audits, and cooperate. In addition, necessary information and opinions are exchanged with the Internal Audit Department. The Internal Audit Department reports the results of the Group's operational audits to the Audit and supervisory Board Members.

Independence_Criteria_of_Outside_Executives (104KB)

Attendance at Board Meetings by Outside Directors and Audit & Supervisory Board Members, and their Activities

| Category | Name | Number of Board of Directors meetings attended | Number of Nomination and Compensation Committee meetings attended | Number of Audit & Supervisory Board meetings attended | Status of key activities |

|---|---|---|---|---|---|

| Outside Directors | Tokio Matsuo | 19/19 meetings | (Nomination) 6/6 meetings (Compensation) 7/7 meetings |

- | He has extensive experience and broad expertise as a corporate manager, including having served as representative director of an operating company. At the Board of Directors meetings, he provides advice regarding the Company's sustainability activities from medium- and long-term perspectives as well as makes management decisions and provides oversight appropriately from a broad-based perspective. In addition, as Chairperson of the Nomination and Compensation Committees, he leads fair and transparent operation of the Committee meetings regarding succession planning, the composition of the Board of Directors, the election of Directors and Audit & Supervisory Board Members and matters concerning compensation, etc. |

| Atsumi Eguchi | 19/19 meetings | (Nomination) 6/6 meetings (Compensation) 7/7 meetings |

- | She has broad knowledge and abundant experience, including having engaged in research & development and public relations/communications divisions at an operating company. She makes management decisions and provides oversight appropriately at the Board of Directors meetings from a multi-faceted perspective including corporate communication and diversity. In addition, she provides expert and specific advice on the election of Directors and Audit & Supervisory Board Members and the compensation system with consideration of recent trends and other companies' cases at the Nomination and Compensation Committees. | |

| Daisaku Abe | 14/14 meetings | (Nomination) 4/4 meetings (Compensation) 4/4 meetings |

- | He has abundant experience and broad knowledge, including having engaged in IT & systems and corporate planning at financial institutions for years and overseeing overall corporate management as a corporate manager. At the Board of Directors meetings, etc., he makes appropriate management decisions and provides oversight, such as providing comments on the optimization of the business portfolio and on financial strategies from a management perspective. In addition, he provides advice for improvements on the election of Directors and Audit & Supervisory Board Members and the compensation system with consideration of recent trends and other companies' cases at the Nomination and Compensation Committees. | |

| Keiko Tanaka | 14/14 meetings | (Nomination) 4/4 meetings (Compensation) 4/4 meetings |

- | She has broad knowledge and abundant experience, including having engaged in a public relations/marketing division at an operating company. She makes management decisions and provides oversight appropriately at the Board of Directors meetings from a global perspective including sustainability. In addition, she provides advice for improvements on the election of Directors and Audit & Supervisory Board Members and the compensation system with consideration of recent trends and other companies' cases at the Nomination and Compensation Committees. | |

| Outside Audit & Supervisory Board Members | Masahiro Yamamoto | 19/19 meetings | - | 15/15 meetings | He has professional knowledge regarding finance and accounting as a certified public accountant. Leveraging his abundant experience and expertise as an accounting expert, he provides comments as necessary from an independent and objective standpoint. |

| Tadashi Kanki | 19/19 meetings | - | 15/15 meetings | In addition to the experience as a Standing Audit & Supervisory Board Member at a listed company, he has broad knowledge and experience in sales and corporate planning at financial institutions. Leveraging this experience, he provides comments to encourage effective and appropriate supervision of overall management from an independent and objective standpoint. | |

| Makiko Terahara | 14/14 meetings | - | 10/10 meetings | She has professional knowledge regarding corporate legal affairs as an attorney at law. Leveraging her professional expertise in determining the appropriateness of overall corporate activities, she provides comments as necessary from an independent and objective standpoint. |

* As of the end of March 2025

Internal Control System

Basic Policy for Internal Control System

Executive Compensation

Disclosure of Policy on Determining Compensation Amounts and Calculation Methods, etc.

The Company considers the executive compensation system to be a crucial component of corporate governance. Accordingly, in June 2018, it established a voluntary "Nomination and Compensation Committees," chaired by an Outside Director, while the Board of Directors has also established the following policy.

Basic Policy

- 1.The compensation system shall support the achievement of the Company's mission and vision.

- 2.The compensation system shall be designed to eliminate short-term bias and motivate the medium- to long-term improvement of corporate value.

- 3.The compensation system shall be effective in maintaining and securing outstanding talents.

- 4.The compensation system shall be designed in a transparent, fair and reasonable manner from the standpoint of accountability to stakeholders including the shareholders and employees, and shall ensure appropriate determination processes.

- 5.The compensation system shall be aligned to the roles and responsibilities entailed by each rank and to performance.

<Method for the determination of compensation of Directors and Audit & Supervisory Board Members>

The policy for determining compensation, etc. of individual Directors is determined by the voluntary Compensation Committee which is chaired by an Independent Outside Director and consists of four Outside Directors and two Representative Directors (Chairperson: Tokio Matsuo), with the aim of ensuring compensation commensurate with the company's stage. Specifically, it is determined by the Board of Directors upon deliberation of (i) the basic policy for compensation; (ii) the compensation system; (iii) the compensation levels; and (iv) compensation item composition ratio; among other things, based on comparative verification against benchmark groups. The amount of each compensation to be paid shall be determined by the Compensation Committee delegated by the Board of Directors from the viewpoint of the objectivity and transparency of the operation of said system.

With respect to compensation, etc. of Audit & Supervisory Board Members, the amount of basic compensation (fixed compensation) shall be determined through discussions among the Audit & Supervisory Board Members, and shall be within the range of the total amount of compensation, etc. approved by the General Shareholders' Meeting in advance.

<Compensation system, calculation System, and determination Process>

Compensation of Directors (excluding Outside Directors) consists of three components, namely, "basic compensation," "performance-linked compensation," and "stock-based compensation." Outside Directors and Audit & Supervisory Board Members receive only basic compensation (fixed compensation). Until FY2022, the ratio between each compensation of Directors was roughly targeted at 65:30:5 when business performance targets are fully achieved. From FY2023, in order to raise awareness among Directors of improving business performance and increasing corporate value over the medium to long term, the design of the system has been changed to set the ratio to 55:25:20 when business performance targets such as consolidated ordinary profit, etc. and other KPIs of the Medium-Term Management Plan are fully achieved. Thus, the ratio of performance-linked variable compensation (performance-linked compensation and stock-based compensation) has been raised to approximately half of the total.

The retirement benefit system for Directors and Audit & Supervisory Board Members was abolished on the day of the 92nd Ordinary General Shareholders' Meeting held on June 27, 2007.

<Compensation system for Directors in FY2025>

| Type of compensation | Basic compensation | Variable compensation | |

|---|---|---|---|

| Performance-linked compensation | Stock-based compensation | ||

| Contents | Fixed compensation in accordance with rank | Compensation in which the total amount of payment is determined based on the total amount of dividends or consolidated ordinary profit for the fiscal year, and allocated and paid in accordance with job rank by adding individual evaluations. | Compensation in which the total amount of payment is determined based on the achievement ratio of the Medium-Term Management Plan, and paid in the form of the Company's stock in accordance with job rank and individual evaluations. |

| Eligible for payment | Internal Directors / Outside Directors | Internal Directors only | Internal Directors only |

| Payment timing | Monthly | Twice a year | At a certain time after the end of each target period or upon retirement (*Subject to transfer restrictions: Until the date of retirement from all positions as Directors, etc. (however, if a Director, etc., continues to serve as an Audit & Supervisory Board Member after retiring as a Director, etc., until the date of retirement from such position)) |

| Payment method | Cash | Cash | Stock (at a certain time after the end of each target period or upon retirement) and cash (only upon retirement) |

| Method for determining the amount of payment | Consolidated ordinary profit or the total amount of dividends, each multiplied by a certain percentage, whichever is smaller, is the basic amount of payment. | Corporate performance achievement rate is determined for the Medium-Term Management Plan period | |

| The basic amount of payment is allocated in accordance with job rank and individual payment is determined in accordance with the achievement rates of business performance targets within the range of 80% to 120%. | Predetermined base points for each job rank is multiplied by a determined corporate performance achievement rate, which will be adjusted by individual achievement rates of financial and non-financial targets within the range of 80% to 120%. | ||

| Ratio (guidelines) *In the case that consolidated ordinary profit, which is a financial KPI of the Medium-Term Management Plan, reaches 35.0 billion yen |

55% | 20% | 30% |

<Compensation, etc. of Directors>

Basic compensation

Basic compensation consists of three components, namely, representative consideration, supervisory consideration and executive consideration, and executive consideration is set according to the job rank.

Performance-linked compensation

Performance-linked compensation is paid to Executive Officers based on the idea that the compensation is distribution of added value generated in a single fiscal year.

This compensation uses "consolidated ordinary profit," which is a performance evaluation indicator, and "total amount of dividends" conscious of shareholders' perspectives as indicators. Consolidated ordinary profit or the total amount of dividends, each multiplied by a certain percentage, whichever is the smaller amount, is used as the basic amount of the compensation, which is then allocated and paid in accordance with the job rank based on individual evaluations. As the compensation composition ratio is set based on the timing when the Medium-Term Management Plan is achieved, if consolidated ordinary profit or total amount of dividends, which is conscious of shareholders' perspectives, is increased or decreased, the ratio of performance-linked compensation in total compensation is designed to be increased or decreased accordingly.

Evaluation for each individual was introduced in FY2021 with an aim to clarify the degree of contribution of each officer to the business performance for a single fiscal year. Certain business performance targets, including sustainability targets, have been selected as evaluation items, and achievement rates are evaluated against those items within the range of 80% to 120%. The basic amount of performance-linked compensation paid, the allocation rate by job rank, and evaluation for each individual shall be determined by the Board of Directors after deliberation by the Compensation Committee.

Stock-based compensation

Evaluation items and evaluation weight for stock-based compensation

The following evaluation items have been established for stock-based compensation, in conjunction with the commencement of the new Medium-Term Management Plan "GOOD FOODS Recipe 2" in FY2025. Specifically, the item added "ROE" to further reinforce the shareholder perspective, as well as added "achievement rate of the target for priority risk responses" to strengthen risk response capabilities.

| Evaluation items for stock-based compensation | ||

|---|---|---|

| Items | Reasons for selection | |

| Financial | Net sales Consolidated ordinary profit ROIC ROE |

Improvement of growth potential Improvement of profitability Improvement of capital efficiency Further reinforce the shareholder perspective |

| Sustainability | Achievement rate of the target for sustainability of marine resources Reduction in CO2 emissions at the Group's business sites Improvement of the mission penetration score among employee engagement Achievement rate of the target for priority risk responses |

Sustainable procurement Contribution to actions toward climate change Active roles undertaken by diverse human capital Strengthen risk response capabilities |

As detailed above, financial and non-financial (sustainability) items have been selected for evaluation of corporate performance, and their weightings have been set to 70:30. Financial targets are evaluated based on the percentage of achievement in accordance with actual results, while non-financial (sustainability) targets are evaluated within the range of 50% to 150%. The number of shares to be granted to individuals is determined by multiplying the predetermined base points for each job rank by corporate performance achievement rates, and then reflecting the individual evaluations. For individual evaluations, KPIs and sustainability items under the Medium-Term Management Plan are used, and the achievement rates are defined within the range of 80% to 120%. The corporate performance achievement rates and the individual evaluations shall be determined by the Board of Directors after deliberation by the Compensation Committee.

The total amount of remuneration, etc. by category of officers for FY2024, the total amount by type of remuneration, etc., and the number of officers subject thereto

The policy regarding the determination of the details of compensation, etc. for each individual Director, was decided by the Board of Directors after deliberation by the Compensation Committee, which is chaired by an Independent Outside Director. The amount paid to each individual for the fiscal year under review was determined by said Committee, under delegation by the Board of Directors, based on said policy; therefore, the Board of Directors has determined that it is in line with said policy and appropriate.

| Category of Officers | Total amount of compensation, etc. (in millions of yen) | Total amount by type of compensation, etc. (in millions of yen) |

Number of Officers paid | ||

|---|---|---|---|---|---|

| Basic compensation | Performance-linked compensation | Stock-based compensation | |||

| Directors (excluding Outside Directors) |

387 | 207 | 108 (Note 1) | 70 (Note 2) | 7 (Stock-based compensation: 7) (Note 3) |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

26 | 26 | - | - | 1 |

| Outside Directors (Note 4) | 45 | 45 | - | - | 5 |

| Outside Audit & Supervisory Board Members (Note 5) | 36 | 36 | - | - | 4 |

Notes:

- 1.The performance-linked compensation of Directors includes the amount estimated to be paid in June 2025.

- 2.Stock-based compensation is scheduled to be paid in July 2025 at an estimated amount of 100% of the achievement ratio of the Medium-Term Management Plan for FY2022 through FY2024. 249 million yen has been recorded as a provision.

- 3.The number of Officers paid for stock-based compensation includes one Director who retired on June 26, 2024.

- 4.Compensation for Outside Directors includes one Director who retired on June 26, 2024.

- 5.Compensation for Outside Audit & Supervisory Board Members includes one Audit & Supervisory Board Member who retired on June 26, 2024.

Deliberation Overview of Compensation Committee in FY2024

| Deliberation overview |

|---|

|